how to reduce taxable income for high earners 2020

How to Reduce Taxable Income Posted by Frank Gogol Updated on April 28 2022. But no one likes paying taxes and youre probably.

5 Outstanding Tax Strategies For High Income Earners

How Can High Earners Reduce Taxable Income.

. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities. Use a Flexible Spending Account FSA. July 24 2020 225242.

A married couple can reduce taxable income by 39000. This can potentially result in a high tax liability for high-income earners. In light of this the administration offers tax conclusions and credits to facilitate this money related weight.

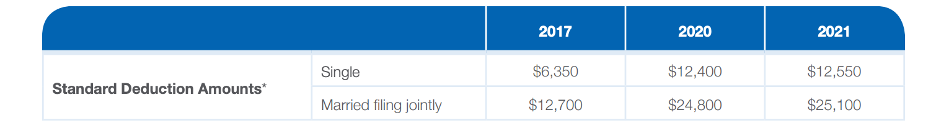

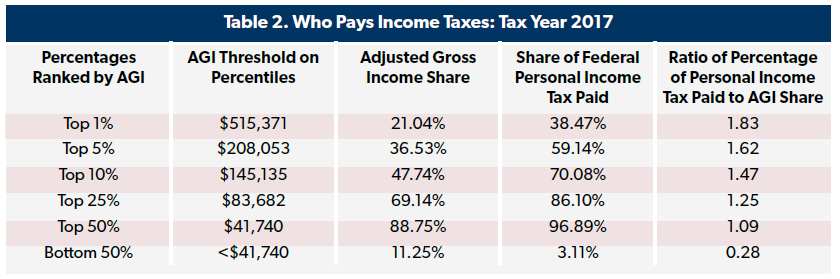

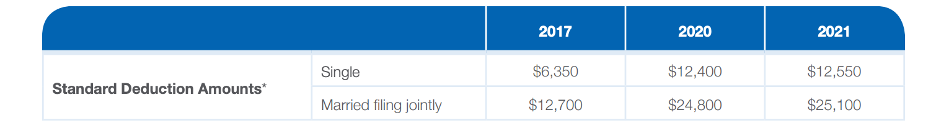

According to the IRS high-income earners pay almost 70 of the total federal income tax. The standard deduction gets adjusted up 150 from 2020 for those filing jointly. Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners.

The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly. This credit will reduce his tax bill to zero. Tax-deferred investment vehicles arent the same as tax-exempt such as a Roth IRA or HSA accounts.

12550 for single filers. How to Reduce Taxable Income. 6 Tax Strategies for High Net Worth Individuals 1.

Establish a donor-advised fund. Contribute to a retirement account. Here are the 5 tax deductions for high earners plus a 6th tax hack at the end of the post.

Contributions now phase out at 124000 and 139000 of modified adjusted gross income. In Georgia however the deduction is. All things considered income tax is commonly the biggest cost for the vast majority.

For individual coverage the limit is 3600. The other way high income earners reduce tax in Australia is by having a savvy and switched on accountant who specialises in this area. A donor-advised fund DAF is an investment account created to support charitable organizations.

One of the best ways that you can lower your taxable income is through pre-tax retirement contributions. You may take an itemized deduction for contributions of money or property to a tax-qualified charity. For family coverage the limit is 7300.

The higher your income tax bracket the more beneficial this itemization is for you. With a DAF you can make a donation receive an immediate tax deduction and then recommend grants to be given from the fund over time. 196000 to 206000 if youre married filing jointly The limits on deducting long-term care premiums also increased to 5430 per person for those ages 71 or over and 4350 for those ages 61 to 70.

If thats you be ready to sell some winning funds later in the year even if. The Retirement Savings Contributions Credit or Savers Credit offers taxpayers a credit of 10 20 or 50 of contributions to retirement savings accounts such as a 401k or an IRA. Donate money goods or stock to charity.

People in the 10 and 15 brackets including joint filers with less than 75900 in income and singles under 37950 pay no tax on long-term capital gains. Nobody needs to pay more in taxes than they legitimately need to. Claim all the tax deductions you can.

Both health spending accounts and. Grab a 0 tax rate on gains. Your mortgage interest on a loan up to 750000 is a line item for itemizing deductions.

At some point there will be tax consequences associated with the distribution of the assets. For family coverage the limit is 7200. Tax Strategies for High Income Earners.

Thats a tax saving between 9360 24 marginal rate and 14430 37 marginal rate. If youre a high-income earner wanting to reduce your taxable income start with these five strategies. Federal tax rules allow certain deductions that.

If your work or assets generate significant income you could pay up to half of your earnings to the US. An effective way to reduce taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement account IRA. If youre charitably inclined charitable contributions can provide outstanding tax benefits.

At Imagine Accounting we work with a number of high income earners to help them legally minimise their tax bill and make the most of their income. Max Out Your 401k The contribution limit for an individual in 2021 is 19500. Here are the Adjusted Gross Income AGI limits for claiming the Savers Credit in for filing your taxes in 2021.

Claim all the tax credits you can. Newly wed couples are entitled to 25100 in contributions in 2020 up 300. For individual coverage the limit is 3650.

Does a High Income Earner Earn a High Income Earner Earn In Australia. In most cases the taxes you pay directly relate to how much you earn. If youre 55 or older you have the option of adding an extra 1000 to your contributions.

Lets say you have a 35 interest rate on your 750000 mortgage. According to 2020 projections household heads will pay 18800 up 150 from 2019. Those with wages between 1200 per week and 2000 each week in Australia experience low productivity as well as highest productivityStatistics from the Australian Bureau of Statistics indicate that since August 2020 Australias median.

If you are self-employed read more tax hacks here. If you would like a second opinion or Free review as to how we. That is approximately 26000 of mortgage interest in the first year.

When you earn a high income you tend to pay a higher percentage of taxes than average earnersThis is fundamentally a good place to be in. You can deduct up to 60 percent of your adjusted gross income each year for gifts of money. What Is A High Income Earner In Australia.

For example in 2020 we plan to deduct all of the following from our taxable income. High taxes means you are financially independent and earning a bigger income.

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Wiser Wealth Management

Biden Tax Plan And 2020 Year End Planning Opportunities

5 Outstanding Tax Strategies For High Income Earners

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

6 Strategies To Reduce Taxable Income For High Earners

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

The 4 Tax Strategies For High Income Earners You Should Bookmark

4 Ways High Earners Can Reduce Taxable Income Truenorth Wealth

Here S A Breakdown Of The New Income Tax Changes Capstone Cpas

Who Pays Income Taxes Tax Year 2018 Foundation National Taxpayers Union

10 Easy Ways To Reduce Tax More Tips From The Etax Experts

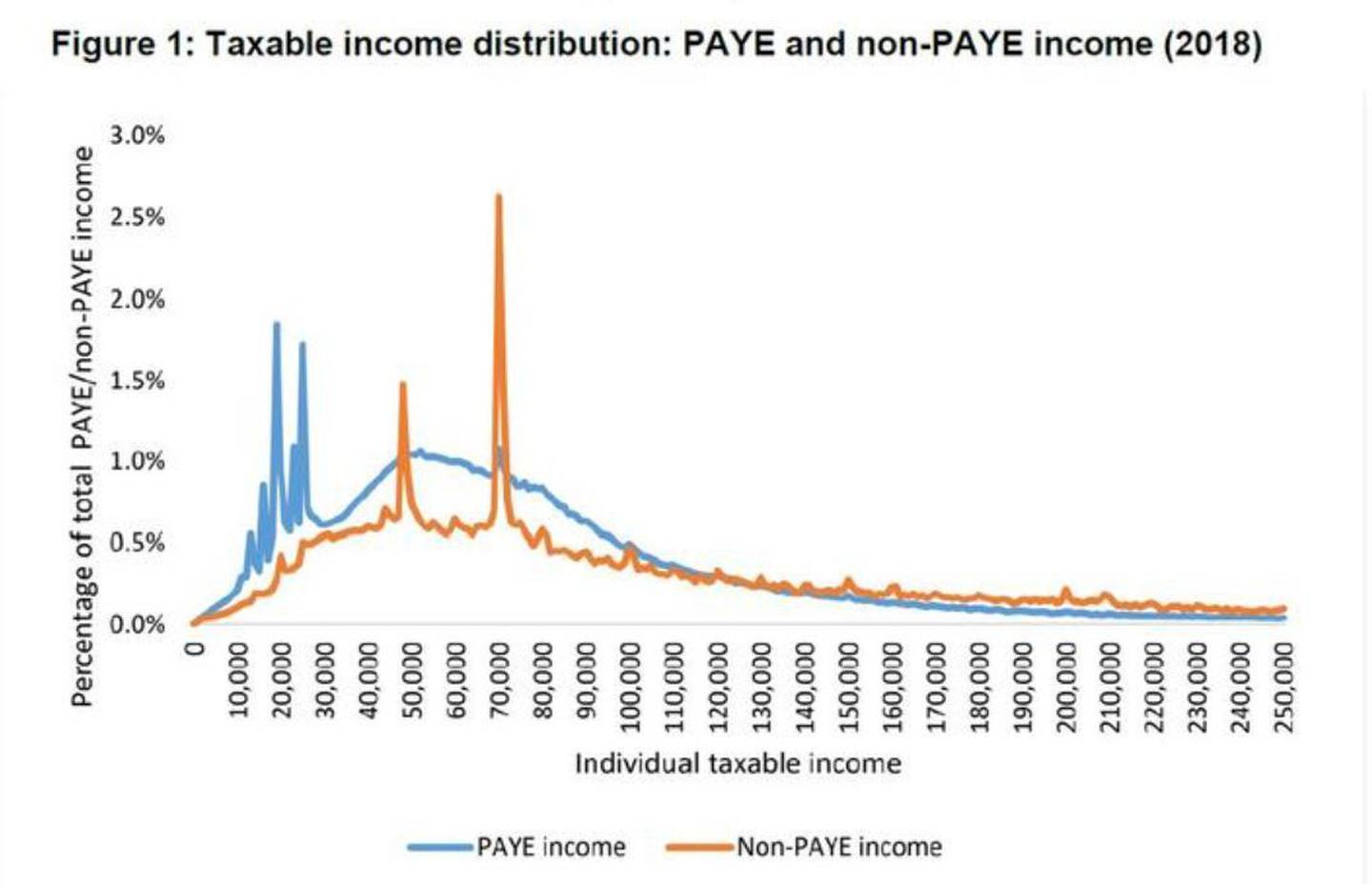

High Income Earners Likely Trying To Avoid New Tax Bracket Ird

The Top 1 Percent Pays More In Taxes Than The Bottom 90 Percent Tax Foundation

Tax Strategies For High Income Earners Wiser Wealth Management

10 Ways To Reduce Your Tax Bill Frazer James Financial Advisers